The Buying Power of Saying “No”

I recently wrote an article about what I learned from the Nordstrom and Amazon Prime Day sales. Without spoiling too much, I was getting unnecessarily overwhelmed by the number of sales and the number of influencers telling me about said sales that I just had to walk away from all of it. I’m calling that article the psychological reasoning to avoid shopping for the sake of a sale, and I’m calling this article the mathematical reasoning for doing so.

Here’s a friendly little disclaimer to say that if you shopped those sales, I still think you’re great. The Nordstrom sale is just a fun, concrete example to use for purposes of this article. However, if you’re battling an insane shopping hangover after the last month and are looking for ways to avoid over consuming during the next great retail sale of 2022, I hope exploring the buying power of saying “no” will be the remedy you’ve been seeking.

The Principal

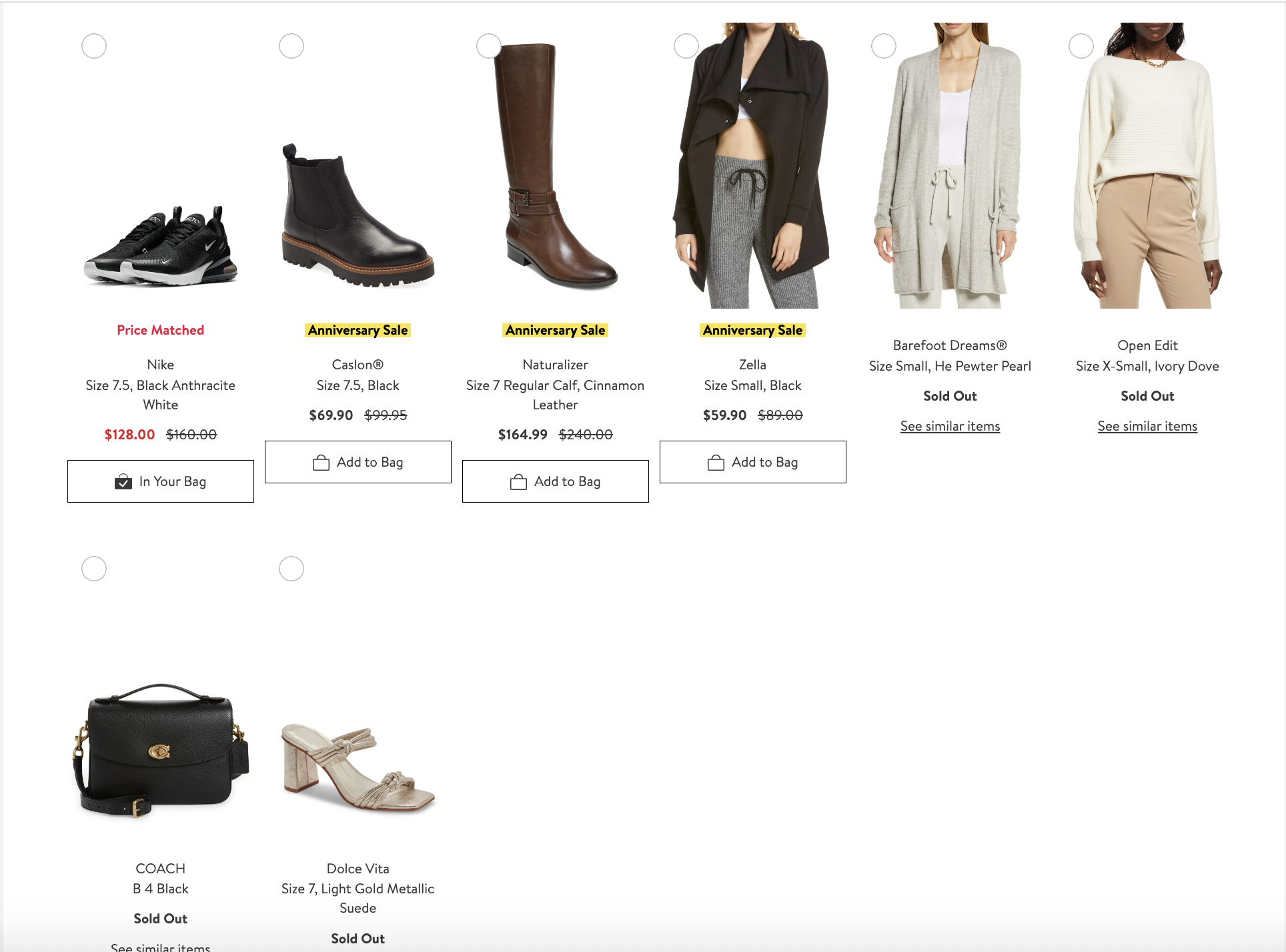

When I was in the throes of deal hunting and Instagram scrolling for Nordstrom sale headliners, I curated a pretty mean wishlist (pictured below.) I felt like everything I picked out was practical, many were timeless, and since I’m an avid review reader, they were also well vetted and rated.

Once the sale opened to “normal people” (aka, me), everything I saved to my wishlist was still available. (This screenshot was taken on the last day of the sale when inspo for this article struck.) While I’m sure they would have brought me both joy and warmth in the upcoming fall season, I felt like I was just shopping for the sake of shopping. So rather than purchasing it all immediately, I totaled the cost of every item on my wishlist to see how much I would be out-of-pocket if I took the plunge and bought it all.

I had to estimate the cost of the purse, since it was sold out at the time I wrote this. I couldn't find the marked down price, but I remember it being somewhere around $125 (if anything, I’m low on that guess.)

The total was $746 for 8 items, and that was when everything was ON SALE! Online shopping makes it way too easy to build a wishlist worth almost $800, does it not?! When I think about my in-person shopping habits, I don’t think I’d ever walk into a store, pick out 8 items that average about $100 each, and checkout without sweating. I’m the queen of buyer’s remorse, so it’s hard to say if acquiring all of this stuff would have brought me more joy than regret, and I guess I’ll never know, but…

I can’t deny that $100 off a luxury purse and $30+ off everything else is a pretty good deal. <rationalization creeps in> Once I felt myself rationalizing spending almost $800, I had to pause and ask myself a question. Did I want all of this stuff before it was on sale, or was I suddenly interested in all of it because it was on sale? Ding, ding, ding…it was the latter.

So I pulled myself together [in the voice of Edna mode] and started thinking about what else I could do with this amount of money.

The Power of Time

What I decided to do with this money isn’t super novel - I invested it. This is a pretty routine practice for me, because I have what I call a “floor rule” for my bank account. At the end of the month, I invest the amount of money in excess of my floor. I’m a relatively risk-averse person, so I like having a little more of a cushion than is probably necessary available in my checking account, but I invest at least something every month.

If my analytics are correct, many of you reading this are around my age - mid-to-late 20s or early 30s. We’re millennials, and according to the headlines, our generation is all over the place when it comes to our viewpoints on saving. Some of us feel financially left behind, some of us feel like there’s no point in saving, and others are way ahead of Gen Xers when they were our age.

If you fall into camp number two and feel like there’s no point in saving, hear me out.

Rather than just telling you about the power of my Nordstrom sale resistance, I think showing you will be more powerful.

First, a little background…

If you’re new to the investing game and a bit wary (not weary, that means tired) of the stock market in general, especially in this bear market and period of high inflation, I think looking at historical data will bring you comfort and teach you some new vocab words along the way. Also, I’d be remiss if I didn’t include Bryan’s tool for distinguishing between the two types of markets, bear and bull. Bears swipe down, and bulls lift their horns up. 🙃

In the following example, we’re talking about investing your money in a fund that follows the S&P 500 index.

S&P stands for Standard & Poor, and they’re the creators of financial market indices.

500 is the number of publicly traded companies that are part of the index

Index is a fancy financial term for list or group

Your money isn’t invested directly into the S&P 500 index. It’s actually put into an index fund and is used to purchase shares of every company in the S&P 500. Since your fund makeup mirrors that of the S&P 500 index, your fund’s performance should mirror the S&P 500’s performance.

We’re also going to use historical average annual returns of the S&P 500 adjusted for inflation over different periods of time in the next example (here’s where I got my info.)

“Adjusted for inflation” just means that someone took the actual average annual return and subtracted the percentage change in inflation. The fed does their best to keep inflation around 2-3% per year, but that isn’t always possible (hello, 2022).

30 years - 7.31%

20 years - 6.4%

10 years - 12.37%

5 years - 13.64%

While the 20-year average rate of return was the lowest of the 4 time periods analyzed, let’s not forget that we experienced the worst recession of our lifetime during that 20-year period, The Great Recession from 2007 - 2009. Those who invested and stayed the course during that rough period and beyond still had the ability to make an average 6.4% return on their money during the 20 year time horizon. This illustrates the power of “buying and holding,” versus selling your shares out of fear when times are tough and taking a loss on your invested funds.

Now, let’s see this investment strategy in action…

Now that we’re familiar with average annual market returns over the last couple of decades, we can use a reliable, historical return rate to help estimate how much the $746 sum of money could be worth after 20 years in the market versus in my closet in the form of 4 pair of shoes, 3 sweaters, and a purse.

Below you’ll see that I took the total of my Nordstrom Sale Wishlist — $746.58 — and invested it in an index fund in July 2022. That amount is known as my principal.

I opted to use the most conservative average annual estimated return rate shown above, 6.4%, to estimate the growth of my invested sum over the next 20 years to reinforce the idea of investing for the long term. You could do this same calc over a 10 or 30 year time horizon with the 6.4%, if you’d prefer!

After 1 year, the value of that sum will grow from $746.58 to $794.36 — that’s about $48 in earnings, also known as interest.

To figure out how much the sum will be worth in July 2024 (two years after investing the money), you’ll take the new balance (principal plus the earned interest = $794.36), and multiply it by 1.064% to get $845.20.

Let’s assume you leave the money alone for a total of 20 years. You let the stock market do its thing, earning an average of 6.4% every year. By 2042, the value of your investment will be $2,582. You will have more than tripled your principal over 20 years. Saving what you would have spent on unnecessary purchases today, increases the buying power of your money tomorrow, assuming those funds are invested.

That, my friends, is the power of compounding interest and the buying power of saying “no.”

Something key to remember is that the rate of return being used in this example is an average annual return from the last 20 years. If I were to plug in true annual return rates instead of the average, you’d see years of negative change and years of positive change, rather than a constant 6.4%. It’s in those times of negative change that people panic, take their money out, and miss out on growth opportunities when the market starts to recover. They’re left with two options: 1) sit back and watch other people’s money grow or 2) re-enter the market by buying more expensive shares with lower overall rates of return, since they missed part of the comeback.

But I get it — waiting 20 years for $1,800 in returns feels a little silly, but the reality is that if you’re investing, you’re likely putting in more than $746 in your lifetime. In 2022, I’ve invested a total of $28,000. While I invested this total in different sums at different times, for simplicity’s sake, we’re going to assume I put in a lump sum of $28,000 in July 2022.

By July 2042, I will have turned my $28,000 investment into almost $100,000. In 10 more years, assuming the same 6.4% return, that sum will have jumped to $180,000. This is why people tell you to start investing as early as possible - the earlier you put money in, the longer you have to earn that compounding interest.

I know it can be scary to wait things out, but if history tells us anything, it’s worth the sweat.

Closing Thoughts

While the sweaters, shoes, and purse would have made me feel like a million bucks today, having a million bucks to my name down the road will eventually make me feel even better and in more substantial ways (like retirement security, the ability to afford emergency expenses, money to support my future family, etc.) - but that’s not always the case! You could make the invest vs. spend argument for every purchase in your foreseeable future, but that’s no way to live.

I hope the point was made clear that I didn’t need that pair of chelsea boots that looks identical to a pair already sitting in my closet, and it’s in those instances that the invest vs. buy argument is a lot more compelling. On the flip side, there’s no chance you could talk me into cancelling any of our vacations, because I know those trips will provide a lot of value to me both in the present AND in the future. It’s all a trade off.

Moral of the story: If you find yourself shopping for no reason other than everyone else is doing it, maybe it’s time to sit back and consider alternative uses for that money or what the value of saying “no” today could mean for your future.