Sunday Summary 21 - 09.25.22

Reading

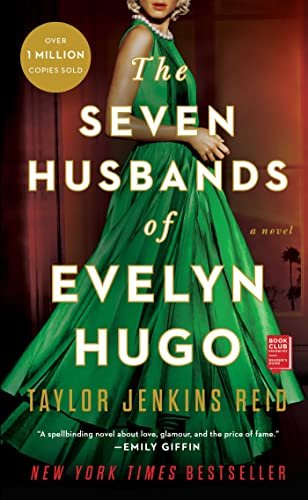

Taylor Jenkins Reid has a hold on my reading list, and I’m not mad about it. This book follows the rise of a movie star, Evelyn Hugo, and the twists and turns both her acting career and romantic life take. This book was nothing like I thought it would be — it’s heartbreaking, exciting, sad, and happy — all at once. There’s truly no wonder the cover is swimming in emblems of recognition.

Want more reading recs? Check out past Sunday Summaries here.

Cooking

This week our menu was inspired by random ingredients that have been taking up valuable real estate in our pantry and refrigerator for far too long.

To figure out how best to use up everything, I went to blogs I love and searched for recipes with the specific ingredients we needed to use. That’s how this week’s grocery list was born!

Spicy Lasagna Soup by Half Baked Harvest

Item to use up: No bake lasagna noodles

Having this tonight while it’s rainy!

Crispy Sheet Pan Pesto Gnocchi by The Defined Dish

Item to use up: Cauliflower Gnocchi

The recipe calls for 18 oz of potato gnocchi, but we’re going to use 9 oz potato and 9 oz cauliflower.

King Ranch Casserole (with veggie modifications) by The Defined Dish

Item to use up: Jarred Jalapenos

We’re replacing the chicken with 1 zucchini, 1 squash, 1 can of black beans, and one whole red bell pepper instead of the half it calls for. Saute veggies with a little garlic powder, onion powder, salt, and pepper, and layer the mix into the casserole where it calls for chicken.

Item to use up: Rolled oats

I’ve been loving a hot breakfast lately, and Bryan is a huge fan of oatmeal. We’re hoping this is good - never tried it!

Turkey Sandwiches (I trust you don’t need a link for this)

Item to use up: Pepperonis

Bryan came home with a hysterical amount of pepperonis for a pizza we cooked last week, and we love a little pep on a turkey sammy.

Spiced Apple Cider Margaritas by The Defined Dish

Item to use up: Last bit of tequila

These looked DELICIOUS and perfect fall, and we can heat up the extra apple cider for a nice weeknight treat.

Watching

I finished this Hulu show this week and was so sad to find out that it was not renewed for a second season. I still think it’s worth the watch, though, especially at this time of year. It’s about a psychic (Maggie) trying to navigate her love life after seeing conflicting visions. It kind of reminded me of a modern day Sabrina the Teenage Witch mixed with That’s So Raven’s visions without the laugh track. It’s super cute, and I’m bummed we’ll never know what happens.

We also started the latest season of The Great British Baking Show on Netflix, and we’re still loving The Rings of Power on Prime Video.

Personal Finance

I recently wrote an article that gives you the 411 on all things 401(k)s. It focuses on the high level details like what it is, the difference between regular and Roth options, withdrawal rules…I’ll stop here before I spoil the whole thing! If you haven’t read it, I encourage you to do so.

I bring this up because I recently got a reminder from my employer to adjust my 401(k) contribution rate before bonuses are paid, and I wanted to remind you too! The examples below could be easily replicated by replacing the fake figures with your own.

The amount you contribute to a 401(k) is usually a percentage of each paycheck rather than a set dollar amount. If you aim to contribute the max ($20,500 for 2022), do a little math at the beginning of the year to determine what percentage of your paychecks totals $20,500. (I get paid 2 times per month, so I use 24 paychecks to calculate it.)

Example: $20,500/24 = $854 per paycheck

Divide $854 by the gross amount of your typical paycheck (ex: $3,000) to determine what percentage of your paycheck you should contribute (ex: 28%). You use gross pay instead of after-tax pay because pre-tax funds are subject to the 401(k) contribution limit. (You can contribute post tax funds too, but that’s not what the limit applies to.)

Since we calculated the contribution rate based on normal take-home pay, you need to adjust the contribution percentage before your bonus is paid or you risk throwing away several months of employer matching contributions — aka, free money!

Example: Your employer matches 50% of the first 8% of your 401(k) contributions per pay period. If you don’t contribute at LEAST 8% to your 401(k) you won’t get the matching dollars from your employer. So, if you max out your 401(k) before the last pay period of the year, you lose out on employer matching since you’re contributing 0%. Employer plans may not offer a match to contributions made to an after-tax account, so you have to plan accordingly.

Now that you understand contributions and matching, let’s see what effect a bonus has on your 401(k) contributions if you don’t adjust the percentage. Our example gross pay and bonus amounts are $3,000 and $5,000, respectively.

Regular Pay Period: $3,000 x 28% = $854 contributed

Bonus Pay Period: $8,000 x 28% = $2,240 contributed

$2,240 / $854 = 2.6 pay periods. In this example, you’ll max out ~3 months early and forgo 3 months of employer matching dollars if you don’t adjust your percentage.

These figures are over-simplified. I recommend using a pay stub from your last bonus period to help you with the math.

Spoiler alert: It’s really hard to contribute the exact $20,500 in 24 pay periods, since it’s all percentage based. I lowered my contribution for the bonus pay period to the minimum percentage my employer would match, but I’m still going to lose one pay period of matching this December. That’s better than losing 5, though, which I would have lost had I not adjusted the rate before I got the bonus!

TLDR: Lower your 401(k) contribution percentage before your annual bonus is paid, if applicable, to avoid maxing out early and losing employer matching dollars.

This example was all about bonuses, but you’ll want to adjust your contribution percentage annually to account for any raises or other changes in income, too. Hopefully this made sense! It got my wheels turning on an entire article dedicated to bonuses, so stay tuned for that.

Things I’m Loving

1.This sweatshirt from Aerie — I had to return something at the mall with Kes recently, and we swear they had the thermostat set to 55 degrees. We both impulse-purchased this sweatshirt, mine in batalia green and hers in powder blue. It’s extremely oversized and so comfy — I got an XS.

2. Apple Weather App — I know this is bizarre. I’ve been fascinated by the weather since I was little, and I’ve been using a paid weather app for years called Dark Sky (yes, I said paid). It gives you alerts before it starts raining, the radar and temps are pretty accurate, and you can view historical and hour by hour weather data. Apple Weather, which has been traditionally bad IMO, recently integrated with (maybe acquired?) Dark Sky in the latest iOS update. Apple weather now has Dark Sky insights with cool Apple visuals — it’s <chef’s kiss>. I have the weather widget on my home screen, and it’s been bringing me joy. Update if you haven’t already!

3. EVERYTHING mentioned in the video below! :)